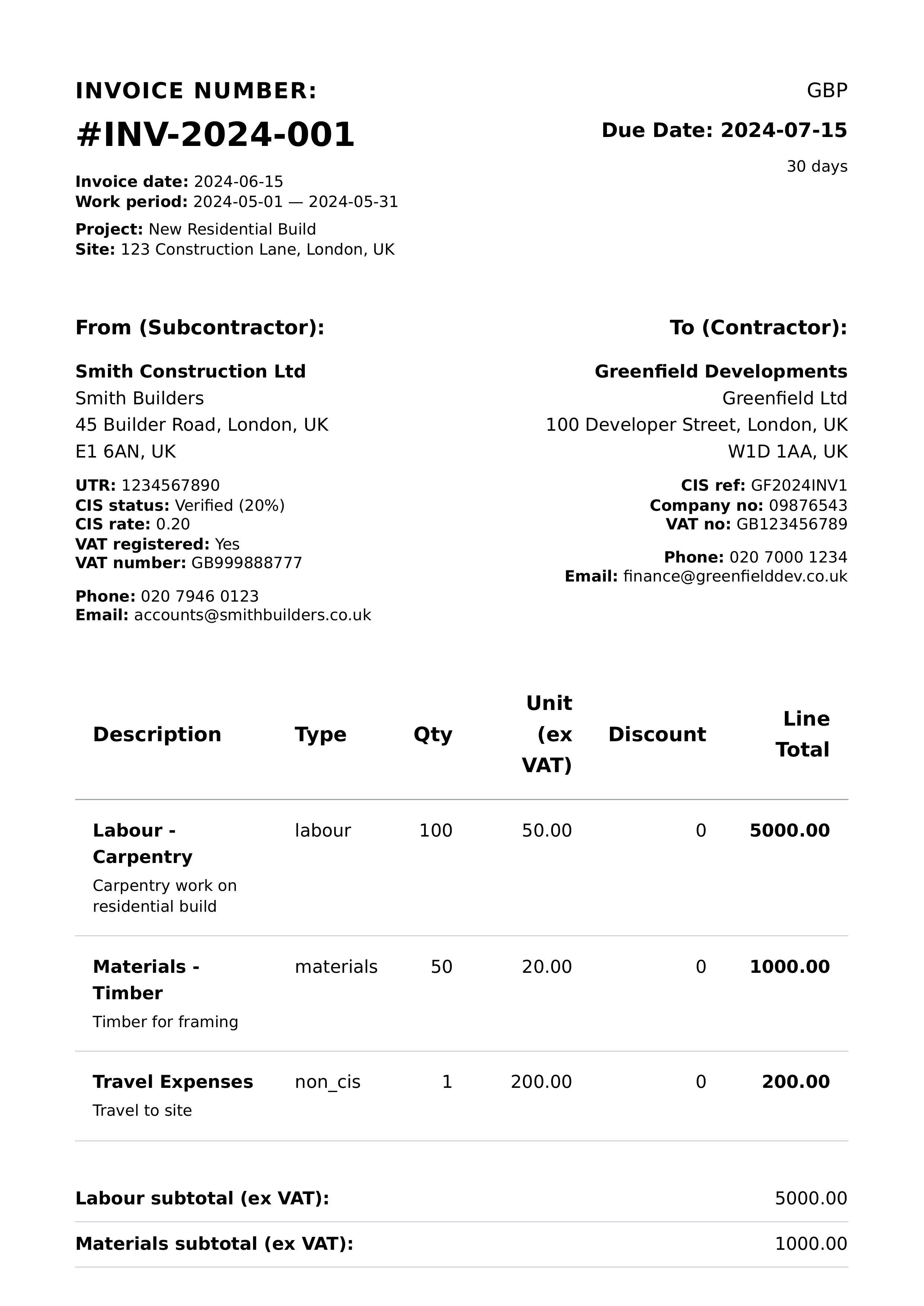

Invoices CIS Compatible Template - Toronto Canyon Orion

Create a CIS compliant invoice using our easy to customize Toronto Canyon Orion template with Tars AI Assistant and MiniApps for seamless data entry and PDF export.

AI Assistant

Tars helps you fill

MiniApps

Smart form UI

Buckets

Save & reuse

API Ready

Programmatic

What You Can Fill

This template includes 5 MiniApps with smart forms for easy data entry

info_cis

22 supported fields

number

Invoice number

date

Invoice date

work period start

Work period start date (recommended for CIS audit)

work period end

Work period end date (recommended for CIS audit)

project name

Project name / reference

site address

Site / project address (common contractor requirement)

currency

Currency

due date

Due date

payment terms

Payment terms

cis rate

CIS deduction rate (0, 0.2, 0.3) derived from subcontractor.cis_status

currency symbol

currency symbol

labour subtotal ex vat

Sum of CIS-applicable lines (labour + plant with operator), excluding VAT

materials subtotal ex vat

Sum of materials/plant without operator lines, excluding VAT

non cis subtotal ex vat

Sum of expense/other lines, excluding VAT

gross ex vat

Total excluding VAT (labour + materials + non-cis)

cis base ex vat

CIS base (labour_subtotal_ex_vat only)

cis deduction amount

CIS deduction amount = cis_base_ex_vat * cis_rate (rounded to 2dp)

vat rate

VAT rate (typical 20%)

vat amount

VAT amount (derived; VAT is NEVER part of CIS base)

total inc vat

Total including VAT (gross_ex_vat + vat_amount)

net payable

Net payable to subcontractor (total_inc_vat - cis_deduction_amount)

message

Optional message

subcontractor

11 supported fields

legal name

Subcontractor legal name (payee under CIS)

trading name

Trading name (if different)

address

Subcontractor address

postcode

UK postcode

country

Country

utr

Unique Taxpayer Reference (UTR) used for CIS

cis status

CIS status determines deduction rate

vat registered

Whether the subcontractor is VAT registered

vat number

VAT number (required if VAT registered)

phone

Contact phone

Contact email

contractor

10 supported fields

legal name

Contractor legal name (payer under CIS)

trading name

Trading name (if different)

address

Contractor address

postcode

UK postcode

country

Country

cis contractor reference

Internal contractor CIS ref / accounts ref (optional)

company registration number

UK Companies House number (if Ltd)

vat number

Contractor VAT number (optional on invoice)

phone

Contact phone number

Contact email

product_cis

7 supported fields

title

Line item title

description

Line item description

item type

Classification for CIS/VAT calculations

quantity

Quantity

discount

Discount percent

price

Unit price (ex VAT)

subtotal

Line subtotal (derived)

bankInfo

6 supported fields

bank name

Bank Name

sort code

Sort Code

account name

Account Name

account number

Account Number

iban

IBAN

swift code

SWIFT Code